Angel Investing and Angel Squad

I've invested in 32 startups in the past two years and so can you

Angel investing used to be a sport of kings. No more. Angel Squad is leading the way to democratize access to angel investing.

I joined Hustle Fund's Angel Squad in October 2023 as part of Squad 13. This blog post shares a look back on my investment experience over the past two years and outlines my thinking behind joining. I also peel back the curtain a bit on my experience and provide some insights for those considering joining Angel Squad.

My Angel Investing thesis

When I joined Angel Squad, Lightspin had just been acquired by Cisco. My thinking was: I will take a small amount of my personal balance sheet (< 10% of my net worth) to invest in ~50 startups and support entrepreneurs with the goal of beating the S&P 500 over the next 10-years, supporting founders, build my network and have some fun!

My angel investing approach is a blend of passive vs active:

- Passive: Build a diversified portfolio of startup investments primarily sourced through Angel Squad's deal flow. Investment amounts range from $1K - $5K. This is more about volume (large portfolio theory)

- Active: Build a focused portfolio of targeted, cybersecurity and agentic development companies I advise and/or invest in. Checks range from $5K - $25K. This is more about relationships and supporting founders and where I can do more value-add. Companies like Kilo Code, Corridor.dev, Detections.ai, Aisy.ai, and AgentSystems.ai.

Beyond the financial return prospects, there's the non-trivial psychological benefits I get when writing angel checks:

- Most of my career in tech has been with smaller startups. In 2023, I had just gone from being an executive of a 50 person startup to being a middle manager of a 90,000 person company. I wanted continued access to the early stage entrepreneurial journey which I love.

- Howard Lindzon's "degenerate economy" thesis rings true and I've personally experienced a dopamine hit when I invest in crypto, fractional shares of modern art, rare wine or whiskey, and of course, startups.

- Investing is a great way to build relationships and network. The triple threat I'm working towards is being a great capital allocator, company operator, and content creator.

One of the psychic benefits of investing is bragging. - Jason Lemkin in a recent 20VC episode

Why Angel Squad?

Democratization: Angel investing is accessible to many, but most people don't know this. Hustle Fund / Angel Squad truly desire to create more investors and give an onramp to an asset class that has historically been reserved for the ultra wealthy. Even now when I tell people I'm an angel investor the perception is I have a ton of money - I've done well but I'm not post-economic. I personally believe in the mission of the squad. Also, I am always fascinated by online communities and I love joining various groups (I'm in dozens of Slack and Discord groups but the two other paid communities I've been a part of include Write of Passage and Small Bets).

Trustworthy: There's a strong sense of trust I get from Brian and the whole Hustle Fund team. They are genuine and have a "no A-holes" policy for the squad. Yes the squad is a money maker for them and they leverage it as a competitive advantage / brand differentiator from other VCs, but the "what's in it for them" does not translate to "the little guy gets screwed". In fact, just the opposite.

Credibility: What better investor to co-lead Angel Squad than Elizabeth Yin who has invested in hundreds of companies at 500 Startups and now Hustle Fund? My own experience working closely with early stage founders, it's a lot of pattern matching and getting a high volume of deals over time. She and the team now have a better filtering mechanism having seen what's worked and what hasn't during their investing vintages of 10-years ago.

Diversity: They have deal flow in unique geographies outside of the typical hot beds. They have founders with deep Silicon Valley roots but also distributed in atypical geographies like SouthEast Asia and South America.

Another point here on diversity: they've also provided unique opportunities I probably would not have found before, such as buying rare whiskey and wine through Vinovest and getting access to pre-IPO secondary offerings via Altra Venture Partners (formerly Hustle Fund Scale).

My investment mix and performance

It's difficult to talk through performance details given the window of investment is 5 - 10 years (or more).

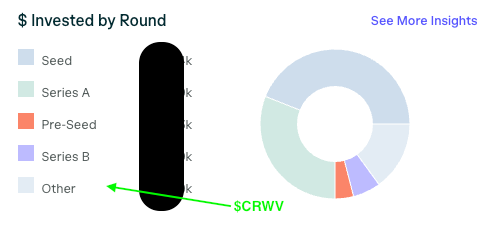

In the past two years I've invested in 32 startups (29 through Angel Squad). Below is the investment breakdown by funding round.

I have one complete loss (this one actually wasn't from a Hustle Fund company, but a deal brought in by an Angel Squad member). It was with a solar company that was mining bitcoin. Had good early traction but I think there was a founder breakup that tanked the company among other reasons. I only put in $1K.

I have one investment that paid out: the Coreweave pre-IPO Special Purpose Vehicle. The interesting thing here is twofold:

- Since the IPO priced below the expected range, I was actually out of the money at IPO, especially with the extra 20% + fees you pay to participate in the SPV. Benefit is you get guaranteed allocation, but drawback is the fees and the 6-month lockup. In this case the shares were common vs preferred as well so that wasn't a benefit of the SPV. At the end of the day, if I would have had the conviction to buy CRWV in the open market at IPO, I would have done better and had more flexibility to sell earlier (like when it hit $180).

- Despite the above, the Coreweave deal doubled my money net of fees and carry in 6-months so I can't complain about that. I was right in my conviction of the opportunity. Next time maybe I just take my friend Mike's advice and invest in Nebius.

I will note, the Altra Venture SPVs have a higher minimum investment (typically $10K, sometimes $25K) and certain deals are reserved for Qualified Purchasers. Angel Squad minimums are usually $1,000 and for Accredited Investors.

Angel Squad experiences and other perks

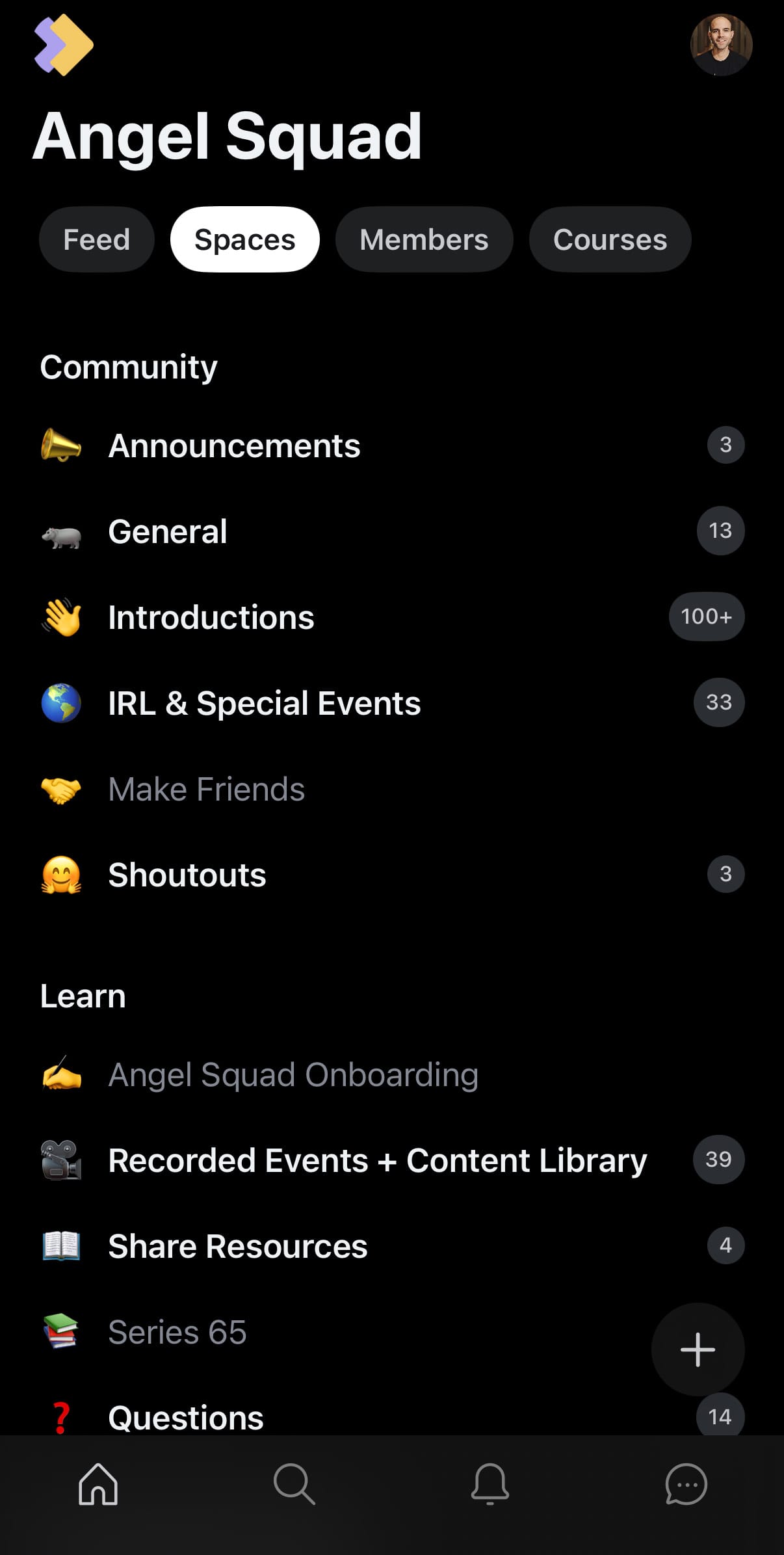

I am more of a passive participant in most Angel Squad activities. I enjoy watching a recap of some of their exclusive content they do for squad members but rarely attend live usually due to time constraints. I'll listen later at 2x speed as they share out all recordings which is helpful.

The Circle group chat I drop into about monthly, sometimes more often if there's something I see that peaks my interest. Mostly Angel Squad gives me deal flow and opportunities. I do hope to attend Camp Hustle some time!

They also have On Demand Courses that I have found valuable. Deal review framework, deal mechanics, term sheet basics, intro to private markets... All good stuff they could probably charge for if they wanted to.

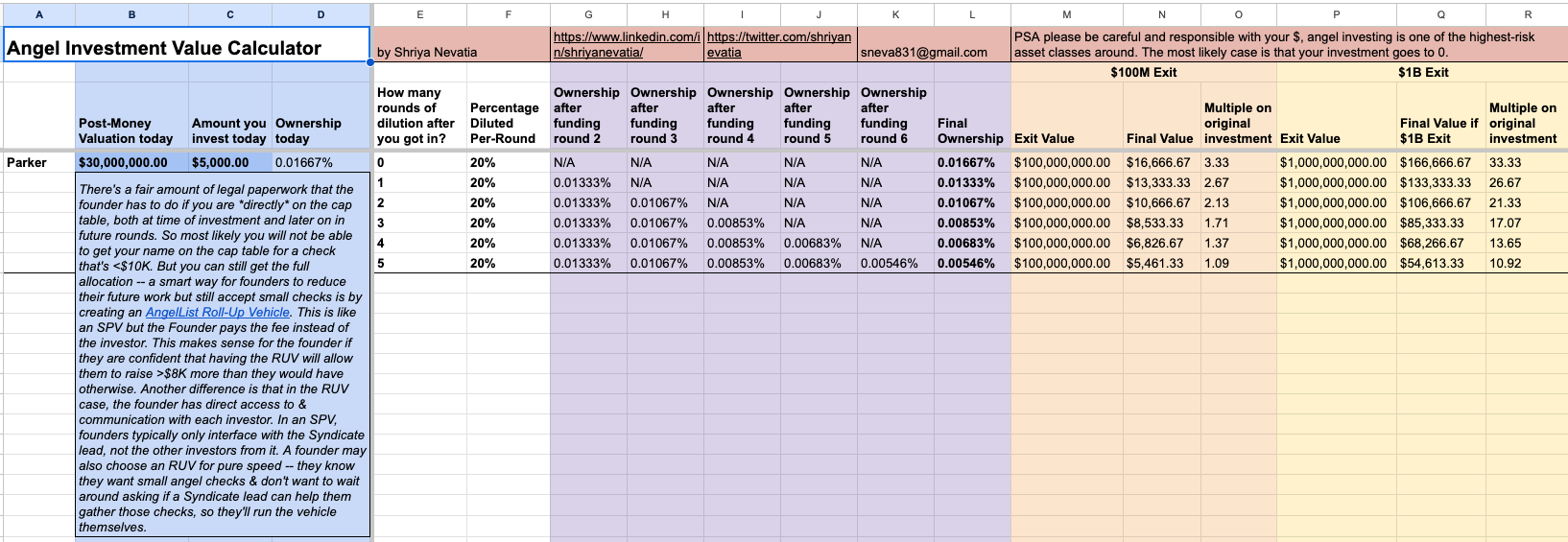

Through the community I've also been able to get access to cool things like this Angel Investment Calculator by Shriya Nevatia.

So should you join Angel Squad and how much does it cost?

I think Angel Squad is a good community with various benefits as I outlined here. It's fit me nicely and is a jumping off point for further investing activities - lots of squad members are interested in working in venture capital full time.

The cost of Angel Squad when I joined was $3,500 and I think it's the same today. You can apply here with my referral link. A Hustle Fund team member will setup a 15-minute call with you.

See you out there!

NOTES:

- Good Reddit thread on Angel Squad

- A note on SPVs related to this recent Bill Gurley tweet:

SPV-life. 😎😎😎🤣 Friends don't let friends buy SPVs. https://t.co/tFWctwwBzK

— Bill Gurley (@bgurley) August 18, 2025

I'd caveat his tweet to say "rich friends with access dont let rich friends with access buy SPVs". If your personal balance sheet is smaller and you dont have the "in" to the exclusive club like Bill, then I think large portfolio theory investing through SPVs will prove to be better than the S&P over the next decade. Time will tell, though.

DISCLAIMER: This post is not investment advice, this is based upon my own personal experiences and is meant for educational purposes only.